The Noël Team is proud to present its inaugural quarterly report for the Westside. By publishing this report, we aim to offer insights about the market we call home and service. We hope you find the information useful and interesting.

Certain markets on the Westside are faring better than others, at least looking at the numbers. This can be attributed to common themes seen in the housing market, such as lack of supply, and an increase of municipalities imposing wealth taxes on assets, including homes. This is happening not just in cities in the Los Angeles Metropolitan Area, but also around the country and the world [1].

For the first quarter report of 2023, we will be comparing figures concerning single family homes sold in Q1 2023 versus all of 2022 in select Westside neighborhoods. It features statistics, such as average sold price and average days on market. The information was sourced from the MLS between April 4 to 7, 2023, so any additional information about properties sold in March inputted in the MLS after these dates may not be reflected in the report.

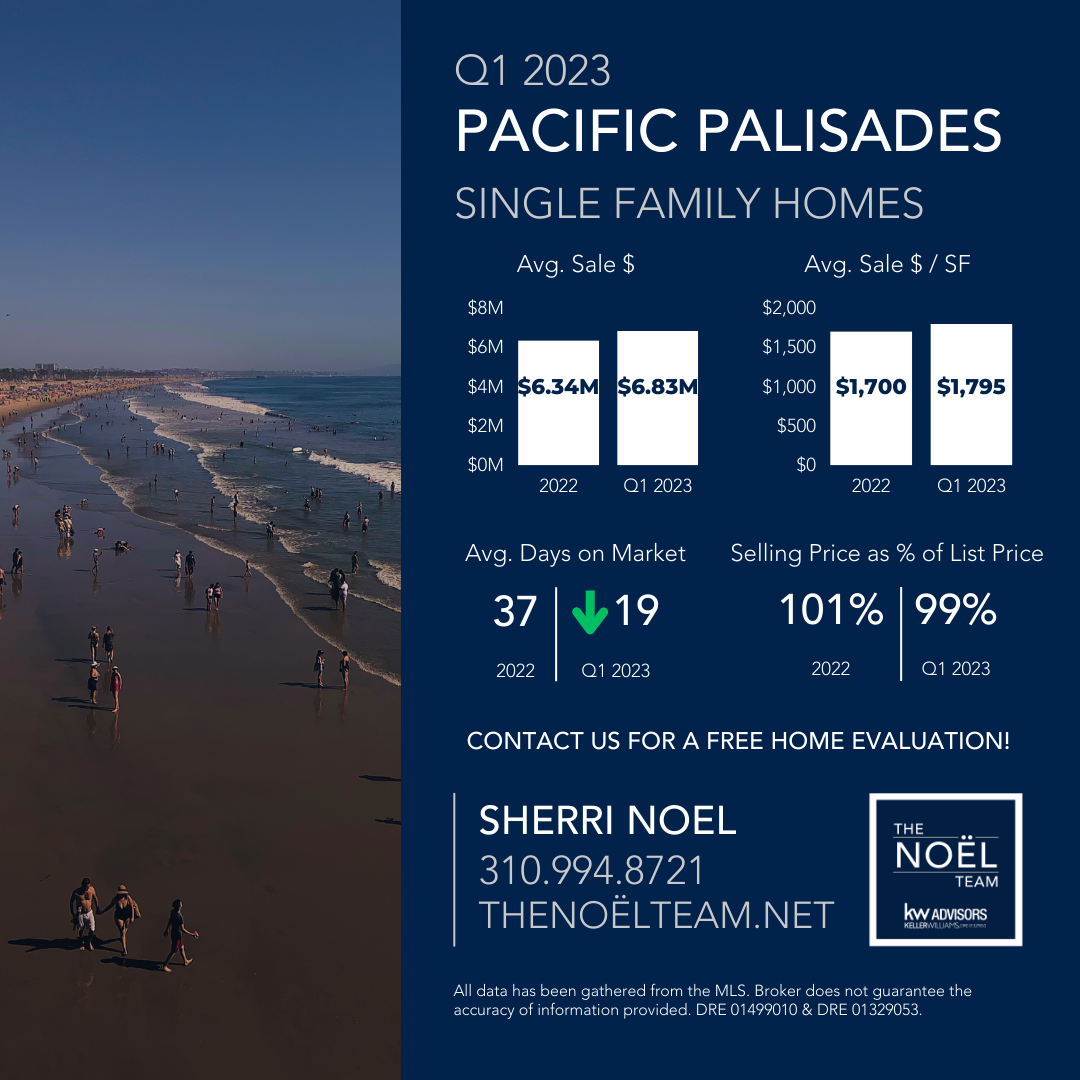

PACIFIC PALISADES –

The increase in average sale prices in Q1 2023, compared to 2022 figures could be attributed to Measure ULA, the transfer tax that affected almost exclusively affluent neighborhoods in the city of Los Angeles, since the law applies to homes that are sold at prices of $5 million and above, starting April 1. Interestingly, but perhaps not surprisingly, the majority of this year’s home selling activity over $5M happened in March, just before the measure went into effect. As we mentioned in our March Market Update [2], almost 3 out of 4 homes sold in March in the Palisades were over $5M. As a result, some of the sellers of these assets felt the pressure to divest before the start of April, so perhaps this may explain, in part, why the number of days on market went down so dramatically, from 37 in all of 2022 to 19 in Q1 2023.

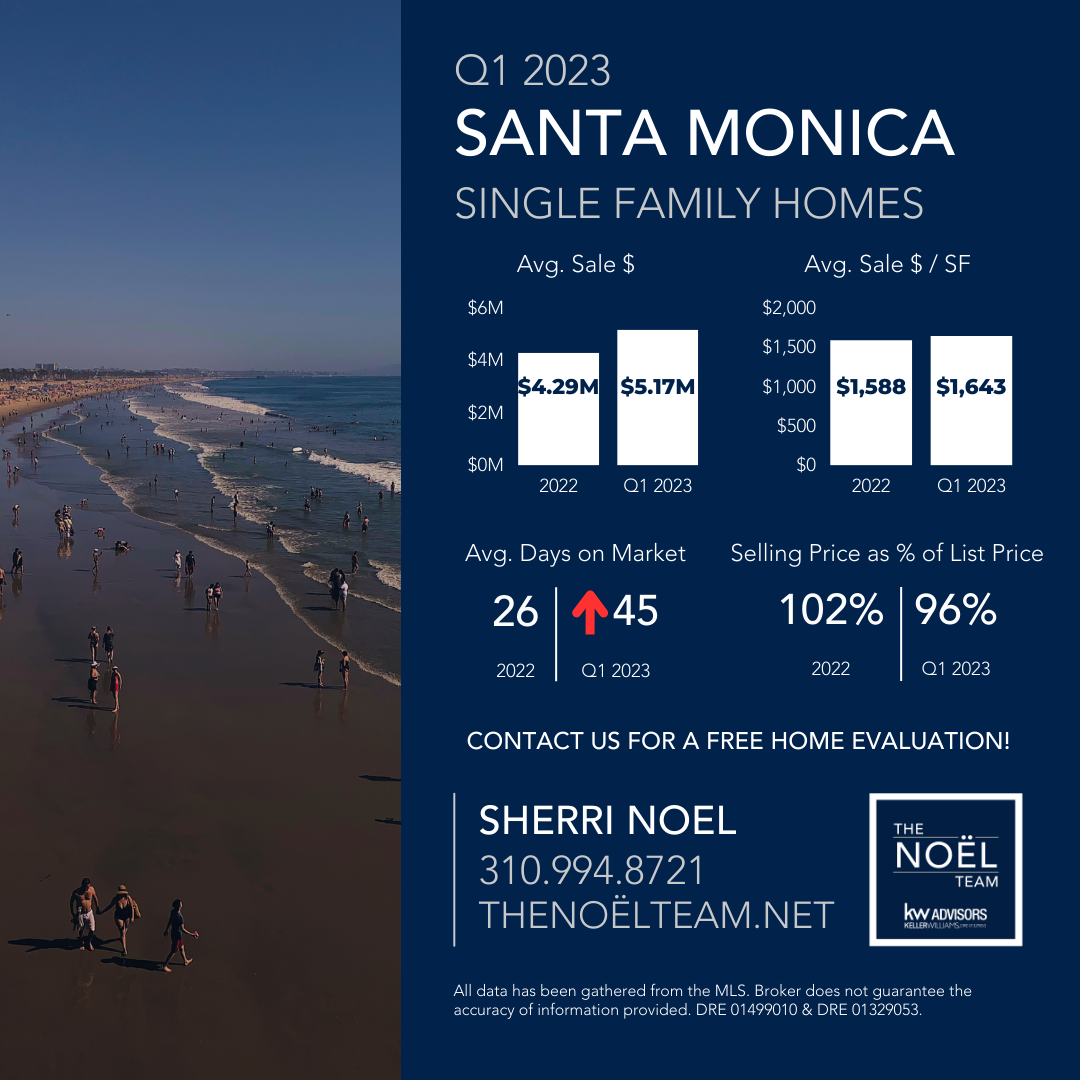

SANTA MONICA –

Seemingly almost in unison, the city of Santa Monica’s own version of the transfer tax, Measure GS went into effect one month earlier than the LA version, starting on March 1. However, this measure applies at a higher threshold – at $8 million and above. Again not surprisingly, the overwhelming majority of $8M+ home sales in Santa Monica (10 of the 11 $8M+ homes) sold in the month prior to the law being implemented (February). Is the big drop in homes sold over $8M from February to March attributable to the transfer tax? Or are there other factors in play? Time will tell. It will be fascinating to see what the activity of the Santa Monica ultra luxury housing sector is in the months to come.

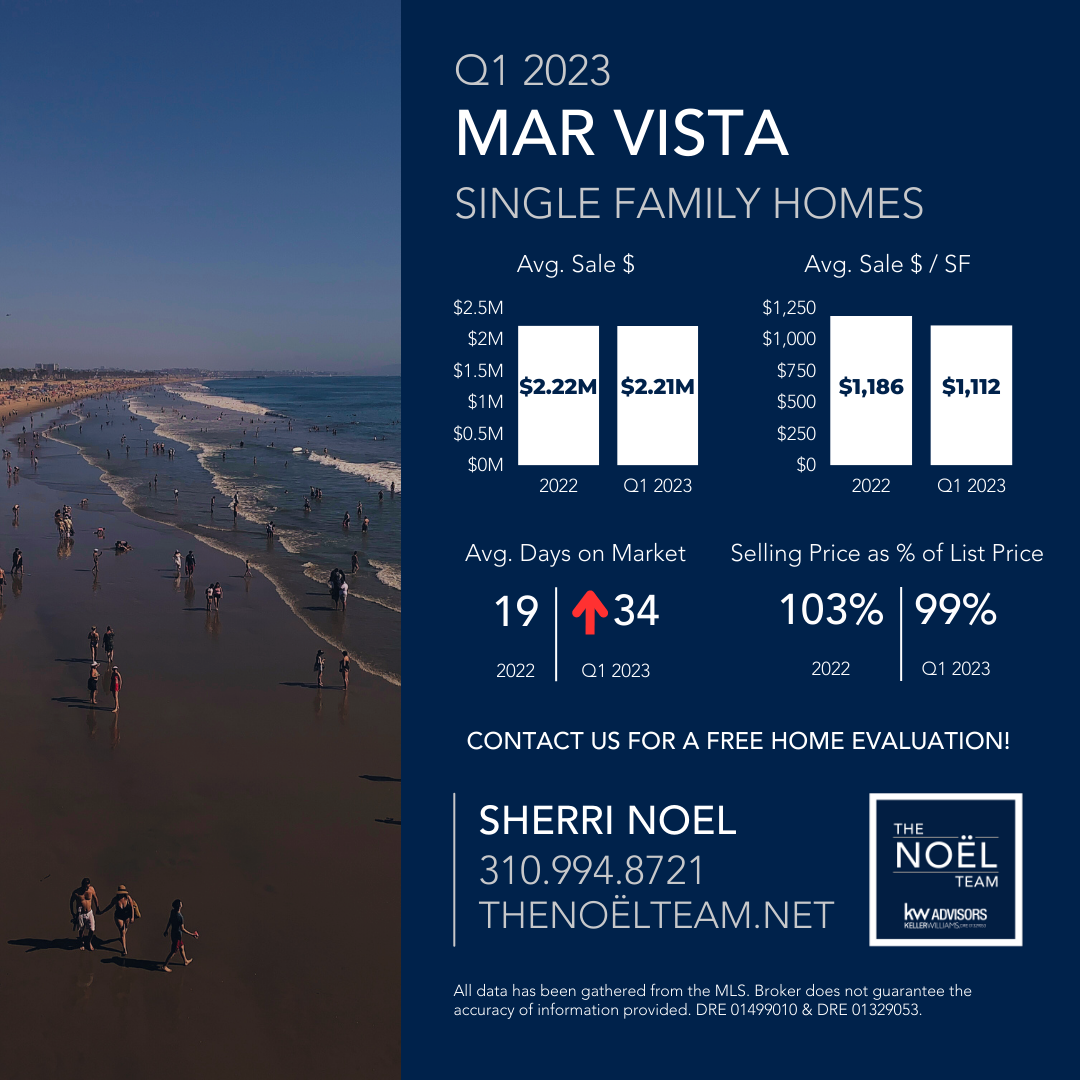

MAR VISTA –

The lack of supply in Mar Vista kept home prices relatively stable in Q1 2023 versus 2022. In calendar year 2022, the average single family home sold for $2.22M, decreasing just by $10,000 in the first quarter, to $2.21M. However, as is seen in many submarkets in Los Angeles, including some of the ones we cover in this report, like Santa Monica and Culver City, homes are staying on the market for longer. The average days on market was 34 in Mar Vista, compared to 19 in 2022.

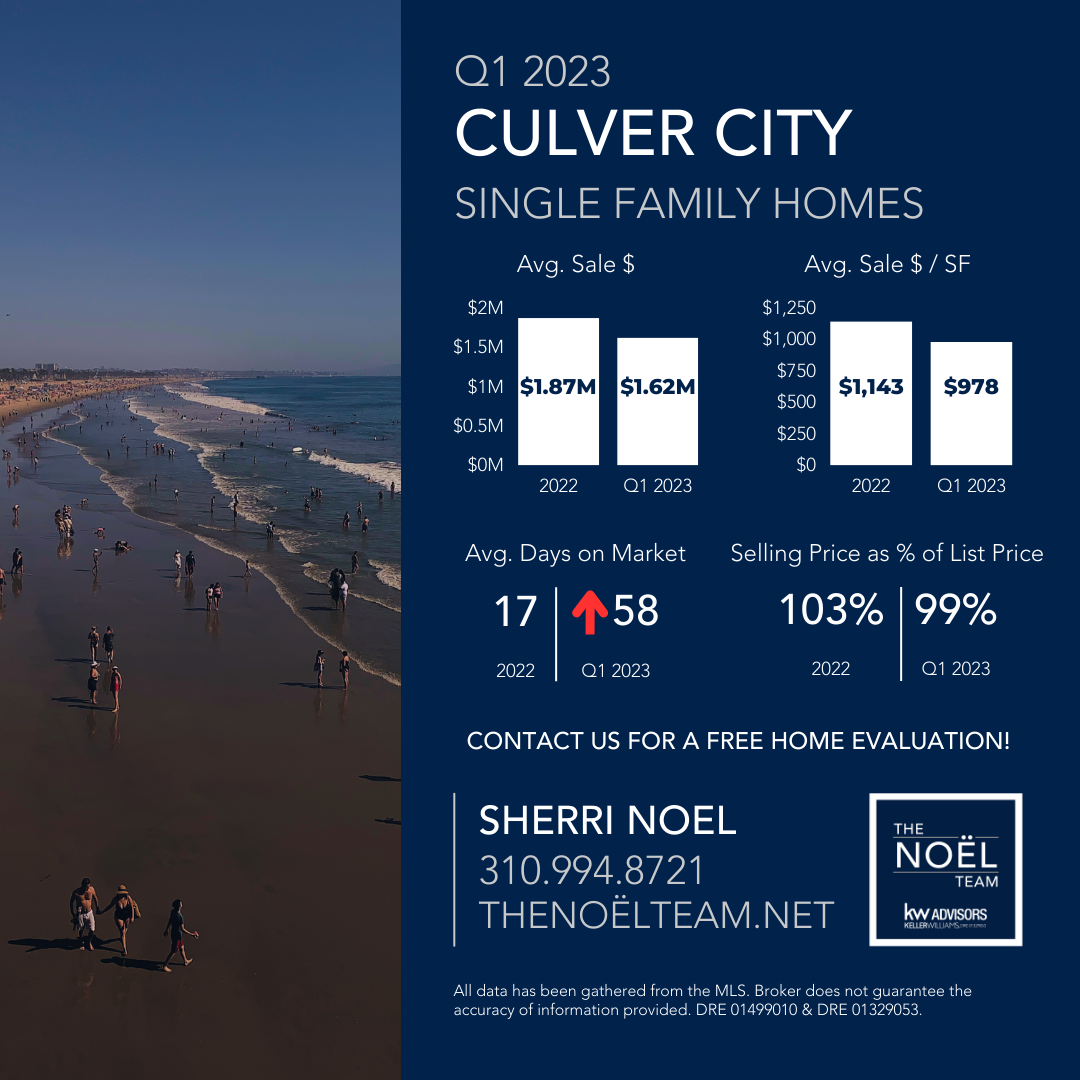

CULVER CITY –

With the huge rise of Culver City single family home prices, having almost tripled over the past 10 years, the market was perhaps due for a correction in Q1, down $250,000 from 2022, to $1.62M in Q1. Until recently, Culver City’s rise was due to many macro factors, like a booming economy and relatively lax Federal Reserve policies, but also due to micro factors, like its central location in Los Angeles, which have motivated many companies such as Amazon and TikTok to set up offices in the city [3]. While many companies like Apple are planning to move in the coming years, it will be fascinating to watch if these tech titans and other companies have a neutralizing or positive effect on home value trends in the coming years.

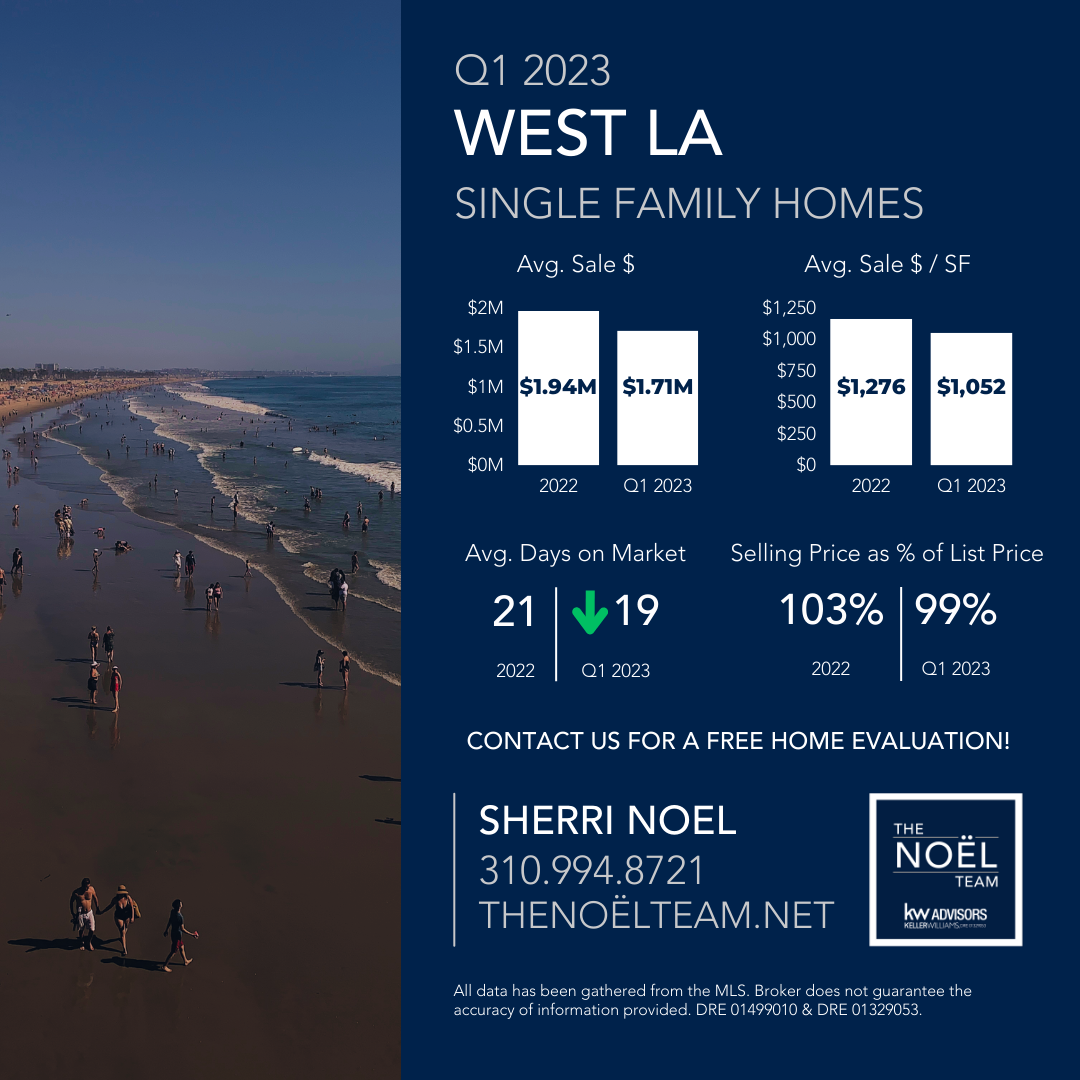

WEST LA –

Similar to Culver City, West LA experienced a price decrease, based on Q1 SFH average sale prices. In 2022, the average home sold for $1.94M, whereas this past quarter the average was $1.71M. Last quarter, a total of 20 single family homes were transacted, spending on average 19 days on market. This is in contrast to the 32 homes that were sold in the first quarter of 2022, with an average of 15 days on market. Some notable West LA homes that were sold are blocks away from the Expo Line stations in the neighborhood, often off-market and transacting for upwards of $2.5-3 million. This indicates the high desirability of properties near mass transit zones.

CONCLUSION

It will be interesting to see how the Pacific Palisades and Santa Monica real estate markets perform after the transfer tax legislation. Will more or less homes over $5 million and $8 million be sold in these markets, respectively? According to Knight Frank, prices of prime property in Los Angeles are forecasted to increase 4% in 2023. However, these expectations may not match reality. We will keep track of the numbers and update you in next quarter’s report.

Sources

[1] https://www.knightfrank.com/siteassets/subscribe/the-wealth-report-2022.pdf